Renters Insurance in and around Olathe

Olathe renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Calling All Olathe Renters!

Home is home even if you are leasing it. And whether it's a townhome or a house, protection for your personal belongings is a wise idea, even if your landlord doesn’t require it.

Olathe renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Safeguard Your Personal Assets

Renters frequently underestimate the cost of replacing their belongings. Just because you are renting a property or condo, you still own plenty of property and personal items—such as a laptop, smartphone, set of golf clubs, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why go with renters insurance from Debbie Swinney? You need an agent with a true desire to help you evaluate your risks and choose the right policy. With wisdom and efficiency, Debbie Swinney stands ready to help you keep life going right.

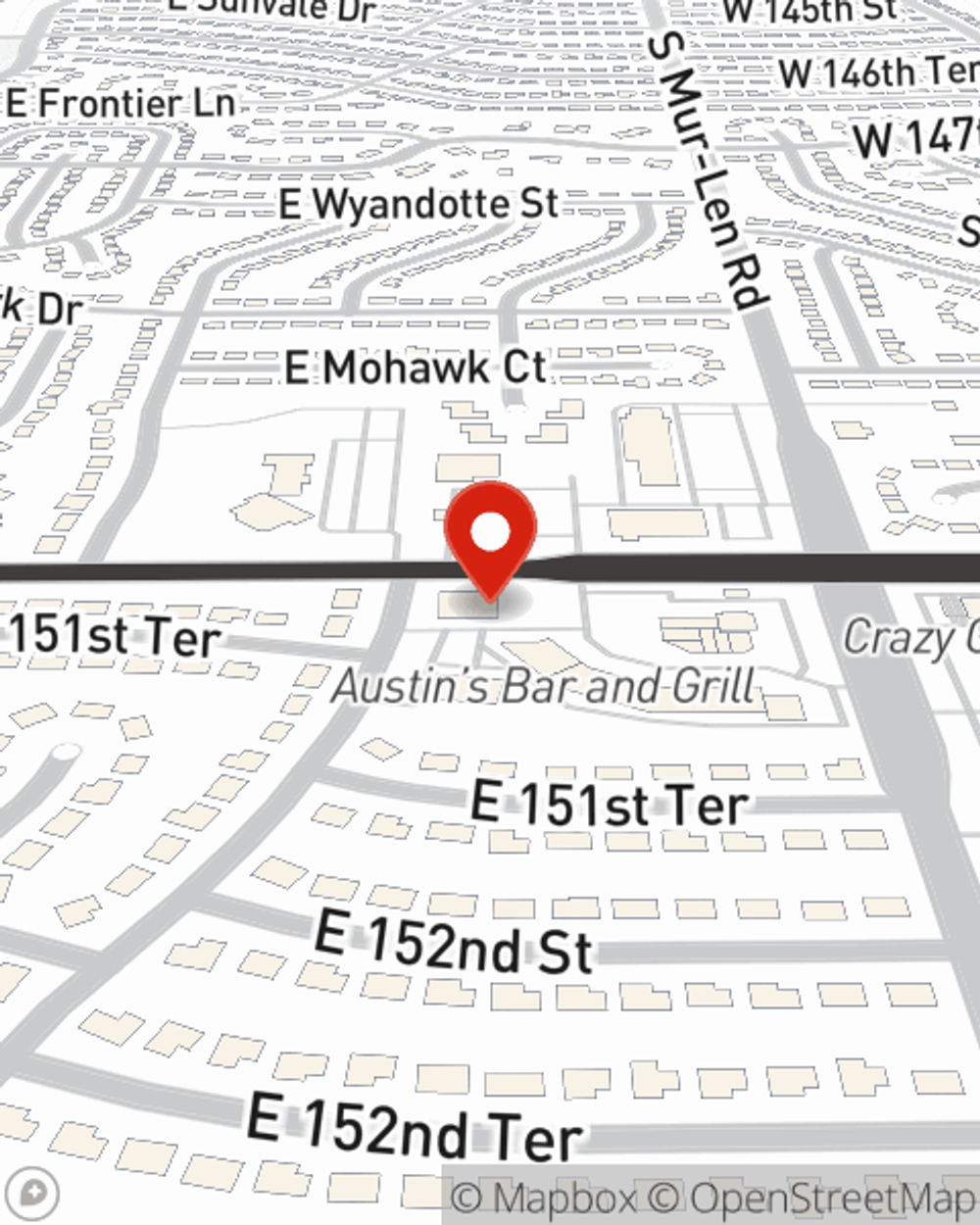

Renters of Olathe, contact Debbie Swinney's office to learn more about your specific options and how you can save with State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Debbie at (913) 782-3289 or visit our FAQ page.

Simple Insights®

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.

Debbie Swinney

State Farm® Insurance AgentSimple Insights®

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.